In brief

- A rushed change to crime reforms outlaws cash transactions over $10,000.

- Costs of living continue to rise, while Kiwis’ primary store of wealth, property, sees further decline in a “disastrous month” according to Real Estate Institute of New Zealand.

- Work visa applications are also slowing, the number of approvals made by MBIE down nearly 30%.

Ban on cash

New Zealand has implemented a new law that prohibits businesses buying and selling particular products valued over NZ$10,000 using cash. The banned products include jewelry, precious metals, motor vehicles, and boats. The law also gives police the power to temporarily confiscate large amounts of cash or gold carried by people they deem suspicious.

The law changes the focus from regulating high-value dealers to outright banning large cash sales. This is in order to reduce the need for resource-intensive investigations and supervision surrounding anti-money-laundering compliance. It is part of a broader anti-gang reform the Government is undertaking.

The law has raised concerns about privacy, individual rights, and financial exclusion. It was pushed through rapidly after being drafted in December, with brief select committees and no industry consultation.

Up again

The cost of living crisis continues to unfold, with April data showing overall food inflation is up 12.5% year on year, from 12.1% last month. Groceries are up 14%, while fresh produce is up over 22%, meat nearly 10% and restaurant food 8.7%.

Down again

Property remains in decline after a “disastrous month” of only 4,262 residential sales in April. This is a 15% decline from April last year, the lowest sales for the month since 1992. The overall national price index fell 12% over 12 months, with the market down 17.5% from the peak in 2021.

Declining visas

Also down is the number of people arriving in New Zealand on work visas, as it declined significantly in April.

According to the Ministry of Business Innovation and Employment (MBIE), 15,873 people arrived on work visas, marking a 22% decrease compared to March’s figure of 20,442. This drop ended the consistent increase in overseas workers since March 2022 after our borders opened. Additionally, the number of work visas approved by MBIE decreased by 29.5%, from 28,065 in March to 19,776 in April.

The fall in numbers may indicate a normalization of the built up demand for foreign workers that developed after pandemic restrictions halted arrivals nearly completely.

What about them banks?

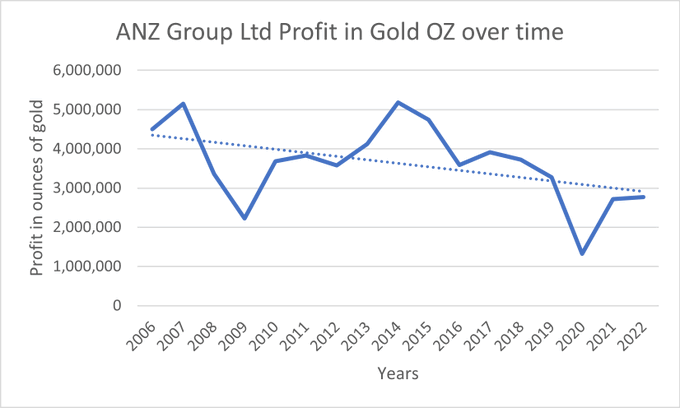

Record profits in the banking sector have been making headlines, with a number of politicians and pundits pushing for inquiry into what they claim are “excess profits”.

However, as one astute twitter user pointed out when measuring bank profits in the world’s oldest currency – gold – they don’t appear to be doing as well.

Perhaps their apparent excess profits -around 8% increase on prior year- are simply caused by the same phenomenon that is driving New Zealand’s workers increased profits and costs of living to increase: inflation.